Inflation is a factor that can quietly erode project budgets long before anyone realizes it. In construction and other capital-intensive industries, where timelines often stretch into years, even a small annual price increase can compound into major cost overruns over time. As project managers, cost estimators, and controls professionals, understanding the impact of inflation and how to account for it isn’t optional. In this article, we explore what drives inflation in today’s construction market, how it affects project budgets, and what you can do to stay ahead.

Understanding Inflation and Its Effects on Project Budgets

Inflation is generally defined as a sustained increase in the price level of goods and services, which reduces purchasing power over time. In construction, this isn’t just about material cost increases. In fact, inflation’s effects ripple through labor, logistics, financing, and contracts.

Construction projects are uniquely sensitive to inflation for several reasons:

- Long project durations: many construction projects span months or years. Over that time, price volatility in materials, labor, fuel, etc., is magnified.

- Fixed-price contracts: when inflation accelerates unexpectedly, contractors often bear the risk, and owners may face quality issues, delays, or disputes.

- Multiple inputs exposed to separate inflation rates: material inflation, labor inflation, energy/fuel inflation, regulatory or compliance cost inflation may all increase at different rates.

Factors Contributing to Inflation in Construction Projects

In construction projects, inflation arises from several interconnected forces that add pressure to costs, schedules, and profit margins.

The key contributors include:

1. Supply Chain Disruptions

Global shipping delays, material shortages, and trade barriers continue to affect construction supply chains. For instance, geopolitical tensions such as the Russia–Ukraine conflict have affected fuel, metals, and energy prices worldwide. Furthermore, key materials like steel, cement, and glass face ongoing price volatility.

2. Energy and Fuel Price Volatility

Fuel and electricity costs have remained unpredictable since the energy shocks of recent years. Rising energy prices increase transportation and production costs across the industry.

3. Labor Market Challenges

Skilled labor shortages persist due to retirements, migration, and competition from other sectors. This drives up wages and training expenses, putting further pressure on budgets.

4. Climate Change and Regulatory Pressures

Extreme weather events and new carbon regulations are reshaping project costs. Compliance with sustainability standards and investment in greener materials add to baseline expenses.

5. Contract Structures and Risk Allocation

Fixed-price contracts often leave contractors exposed to rising costs. Without escalation clauses, inflation quickly eats into profit margins and creates disputes over scope and delivery.

6. Financing and Overhead Costs

Higher interest rates and insurance premiums increase the cost of capital. When inflation prolongs timelines, overheads rise and reduce cash flow efficiency.

7. Market Competition and Bid Strategies

Uncertain material costs make accurate bidding difficult. Contractors are shortening bid validity periods or adding contingencies to manage inflation risk.

Together, these factors make cost control complex. Managing them effectively requires accurate data, flexible planning, and continuous monitoring throughout the project lifecycle.

How Inflation Affects Construction Project Budgets

Inflation can show up in many ways over a construction project’s lifecycle. Below are key impacts project teams must anticipate.

- Material cost escalation: Rapid and sometimes unpredictable price spikes for core materials (copper, steel, concrete, glass).

- Labor cost inflation: Wages, benefits, and even workforce availability can change mid‐project.

- Reduced purchasing power: A fixed budget at project launch may not cover the originally intended scope or quality.

- Profit margin loss: Especially under fixed‐price contracts, contractors may see their estimated margins shrink unless escalation or escalation clauses are clearly defined.

- Budget deviations and overruns: Assumptions made at the beginning about material cost, labor rates, or supply timelines may diverge significantly from actual conditions.

- Project delays & schedule extensions: Waiting longer for materials, labor, or approvals adds both time and cost.

In short, inflation not only increases costs, it also increases risk and uncertainty. If these issues are addressed, they can lead to cost overruns, disputes, and delayed projects.

Strategies for Mitigating the Effects of Inflation on Project Budgets

While inflation can’t be eliminated, it can be managed. The key is to plan ahead, monitor trends, and use data-driven tools to keep control of costs and forecasts.

Regular Budget Reviews and Contingency Planning

Inflation moves faster than most project cycles. Cost estimates set at project approval can quickly become outdated if not reviewed and updated regularly. By updating budgets with the latest market data and adding specific contingency budgets for inflation risk, project teams can avoid unpleasant surprises. Scenario analysis, such as testing the impact of a 10% or 20% rise in material prices on total cost, helps decision-makers plan funding and schedule adjustments early.

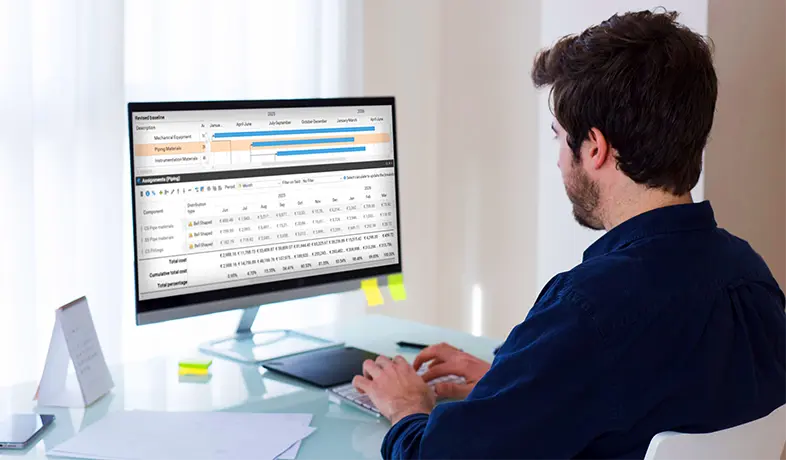

Solutions like Cleopatra Enterprise’s cost estimating software that centralize historical data and offer the possibility to use real-time escalation factors can make these reviews more accurate and less time-consuming.

Contractual Risk Sharing and Escalation Clauses

As previously mentioned, contracts play a major role in how inflation risk is distributed. Wherever possible, escalation clauses should be tied to reliable indices such as steel, fuel, or labor price benchmarks to help maintain fairness between owners and contractors. For high-risk markets, cost-plus or hybrid contracts can create flexibility, while fixed-price contracts should include clear change-management practices for inflation-driven scope changes.

Integrated project controls platforms can support this by maintaining transparent change logs and audit trails, ensuring cost changes are justified, approved, and traceable.

Procurement and Supply Chain Strategies

Procurement teams are the first line of defense against inflation. Securing long-lead materials early and locking in prices can reduce exposure to future spikes. Building a diversified supplier network also helps prevent disruptions from affecting schedules. Many companies are adopting modular or prefabricated approaches to shorten on-site durations and reduce the time that inflation can impact budgets.

Furthermore, aligning procurement data with estimates and cost control sheets in a unified system can help teams anticipate lead times and compare supplier quotes efficiently.

Labor Management and Productivity

One of the most inflation-sensitive cost drivers is labor. Training and retaining skilled workers can stabilize wage growth within the project. Scheduling, digital field management, and optimized resource allocation can boost productivity, which helps offset higher hourly rates. Forecasting labor costs during the estimating phase ensures that bid prices reflect real market conditions instead of outdated assumptions.

Financial Management and Real-Time Cost Control

Inflation affects financing costs as much as materials or labor. Monitoring interest rates, negotiating flexible payment terms, and tightening overhead control are all essential steps to take. Project controls software like Cleopatra Enterprise supports this by integrating estimating, cost control, and forecasting data. This integration provides early visibility of deviations and allows for quicker corrective action before inflationary pressures increase.

To conclude, managing inflation requires foresight, agility, and access to reliable cost data. Software solutions such as Cleopatra Enterprise bring these elements together by connecting cost estimating, forecasting, procurement, and change management in one environment. This gives project teams the visibility they need to make timely, well-informed decisions in volatile markets.

Real-World Examples of Inflation’s Impact on Projects

Below are two examples from industrial and infrastructure projects where inflation and related pressures significantly impacted budgets.

| Project/Sector | What Happened | Key Lessons |

|---|---|---|

| LNG/Energy Infrastructure | Costs in U.S. LNG construction projects surged as new tariffs compounded supply chain constraints. Steel tariffs of 50% added 4.6% to the project cost on top of baseline inflation (Wood Mackenzie). | In the energy and industrial sectors, material tariffs and labor inflation can come together to drive costs up significantly. Projects should model the risk from both inflation and tariffs together, rather than handling them separately. |

| U.S.Federal Highway works/Highway, infrastructure | Since 2020, highway construction costs have increased about 69% according to the National Highway Cost Index. Inflation has reduced a lot of the buying power of infrastructure budgets (Infotech). | Governments need to create realistic escalation assumptions for infrastructure budgeting. Without these assumptions, many projects encounter change orders, delays, or lack of funding. |

As projects become more complex, global, and long-term, inflation risk becomes a more central part of the cost control strategy. If your project is still using static cost assumptions made years ago or relying heavily on fixed-price contracts without escalation clauses, you are already exposed. By staying alert to inflation trends, adopting adaptive contracting and procurement strategies, using real-time monitoring, and leveraging software that provides visibility and flexibility, you can protect your construction budgets from inflation.

For a truly integrated approach that brings together cost estimating, cost control, scheduling, and risk management, consider adopting capital project management software.

In today’s ever-changing markets, large capital projects face increasing pressure to deliver on time and within budget. Project…

Operational efficiency in project management is about achieving more with less: delivering projects on time and within budget…

Related resources

How to Improve the Owner-Contractor Collaboration in Construction

Learn how to overcome key challenges such as mistrust, data silos, and reactive planning to improve the collaboration between owners and contractors in construction projects.

Read blog article

Time-phased budgets in construction explained

Without clear insight into when and where costs will happen, even well-planned projects risk overruns and cash flow problems. A time-phased budget gives project teams a clear roadmap of how costs will unfold over time, making it easier to plan ahead, track performance, and take action before small issues escalate.

Read blog article