“The mining industry is one of the only industries where the problem of underperformance is a structural problem and newly developed mining projects often struggle to finish within budget, and just as often exceed the budget vastly.”

Why do mining projects exceed budgets?

Mining executives often blame project underperformance on foreseeable complexities and uncertainties, having to do with the scope of and demand for the project, the technology or project location, or even stakeholder opposition. No doubt, all of these factors at one time or another contribute to cost overruns, benefit shortfalls, and delays (Bent Flyvbjerg, 2014).

The poor performance of large projects, due to CAPEX overruns are more a rule than an exception, especially in the mining industry. This structural problem in the mining industry is justified by the extensive and complex infrastructural developments required for developing a mine, combined with the uncertainty of the subsoil conditions and the grade and dimensions of the ore body. Additionally, the mining industry traditionally requires large capital investments, prior to the start of production. Due to the complex and comprehensive development prior to production, the large initial expenditures are spent before any revenue is being created (Gordon & Tilton, 2008). Due to these uncertainties, the risk of CAPEX overrun, are not only considered large from a proportional perspective but in absolute terms as well. Mineral consumption, in general, is increasing rapidly as more consumers enter the market for minerals and as the global standard of living increases. As the relatively easy mineable deposits are reaching the end of exploitation, miners are being driven to new geographies, accessing more complex orebodies at greater depths (Pathegama, 2017). This results in a combination of increasing risks and costs.

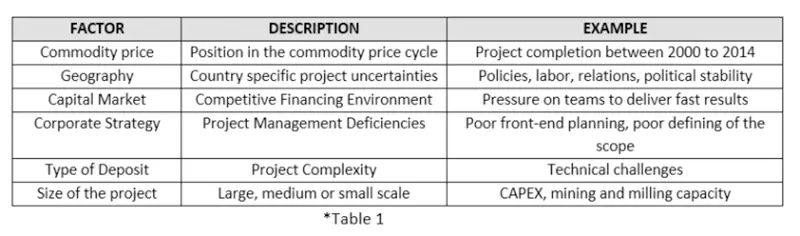

The following factors have been identified causing CAPEX overruns:

Nickel, copper and gold projects are most prone to significant cost overruns. Nickel projects experienced a mean ICO of 45% and copper and gold projects an average of 40%.

How to reduce the risk of CAPEX overruns in mining

1. Risk Identification

All of the items and events within the project are investigated from the perspective of various risk categories and those that could have a negative impact on the project are identified. In this case, the focus would be on the issues that might affect the mining operation right from the pre-mining phase, during the operational phase and the post-mining.

Risk identification is more difficult than it seems. This is why building a mine on a budget is so rare. Market heat and project economics are not often thought of as risk factors contributing to capital cost overruns, but they ARE.

2. Risk Management

In the risk management process, risk events need to be prioritized so that the risk mitigation plans are determined either based on past experience, lessons learnt, best practices, organizational knowledge, industry benchmarks.

3. Integrated business models

Common-sense business models such as integrated design or build teams can offset cost overruns risks that are beyond the control of management.

4. Cost Estimation

Estimating capital and operating costs is one of the most critical stages in any new mining project. Reliable cost estimation will mitigate your operational and financial risk as you build or expand your mining project.

5. Cost Control

Mining companies are now focusing on reducing their mining operating costs and will have to move away from reactive cost-cutting methods and create sustainable programs for cost management. Cost control helps monitor and measure progress on a predefined timeline to identify variances from the estimated value. It will help in achieving quick, real-time results, track the impact of changes in commodity prices and inflation rate in an ongoing mining project.

6. Benchmarking at mining projects

According to Mckinsey & Company, owners and contractors should validate CAPEX estimates through benchmarking at the discipline level as a minimum, and at higher levels of granularity for high-cost disciplines (such as formwork, rebar placement, and pouring for concrete). Capex benchmarks should be as granular as person-hours per meter of piping, or a dollar per person-hour for labour. These detailed benchmarks can validate high-level cost estimates by providing visibility into how the project’s idiosyncrasies will manifest during construction, and how that will impact the overall cost.

Benchmarking also provides an opportunity for the project team to identify cost-reduction opportunities by reflecting on design and front-end planning choices that can lower costs.

7. Feasibility study

A company needed to ensure its budgeting for contingencies was commensurate with the level of engineering contemplated. That was important because failings in engineering were often a major stumbling block with regards to CAPEX overruns.

8. Incorporate an integrated solution

Mining company strategies depend strongly on the current state of the market. When the market is an upside, companies develop marginal high-cost, low-productivity mineral deposits, supported by high commodity prices. But when the market is down, companies respond by slashing costs – a natural response to a shifting market cycle.

Nowadays miners can control the way they operate. The integrated software solution will not only help in creating a strong cost management approach but also achieve optimization in current methods.

Though the above recommendations are critical, no mining project can succeed without a strong and unified team to support it. The project team should never forget about the rigorous project management disciplines supported by transparent communication, problem resolution, end-to-end accountability and dedicated capabilities in construction and operation planning. Furthermore, while these strategies provide a solid foundation, capital project management software offers a comprehensive solution to support these processes, helping project teams achieve transparency, efficiency, and cost control.

*Table 1: Examples of Factors studied by Lwin & Lazo (2016), Pearson et al. (2016), Lwin & Lazo (2016) and Wetterhahn (2018).

Whether you are improving your cost management practices or simply don’t have enough resources to support your cost…

Effective project planning lays the groundwork for success yet challenges often arise beyond the initial blueprint. Among these…

Related resources

The Energy Transition in Mining Projects and Project Controls

The energy transition is resulting a growing demand for metals, fueling mining projects. But, this comes with mining project controls challenges.

The energy transition is resulting a growing demand for metals, fueling mining projects. But, this comes with mining…

Read blog article