Large capital projects are notorious for their complexity, long preparation in advance, and high financial stakes. According to the Association for the Advancement of Cost Engineering (AACE), effective risk management is one of the most critical practices for ensuring that projects are completed on time, within budget, and to plan by taking risk into account as a given instead of something that could occur.

In the absence of structured risk management, projects are far more likely to encounter cost overruns, schedule slippage, and compromised outcomes. For capital-intensive industries such as oil & gas, chemicals, infrastructure, and many more, financial losses can ultimately render the original business case invalid. Adopting robust risk practices helps teams anticipate uncertainties, minimize threats, and maximize opportunities throughout the project lifecycle.

Understanding Project Risk Management

In project management, risk management refers to the process of identifying, assessing, and controlling uncertainties that could impact project objectives in terms of time and money. Far from being a one-off exercise, it is a continuous practice that runs alongside planning, estimating, budgeting, execution, and monitoring.

For large capital projects, where even small deviations can have serious consequences, managing risks isn’t only about defense. It also allows teams to make proactive, data-driven decisions and protect project predictability.

Key Concepts of Risk Management

Project risk management is built upon several foundational concepts:

- Risk identification: Recognizing potential events or conditions that might affect the project’s success.

- Risk assessment: Evaluating each risk in terms of probability and impact, often using structured matrices or scoring systems.

- Risk register: A living document that records risks, owners, and mitigation actions, ensuring accountability throughout the project

- Mitigation and response strategies: Developing targeted actions to reduce the likelihood or consequences of risks.

- Contingency planning: Allocating financial and schedule reserves to respond to risks that materialize. Learn more in our “Managing Contingency Budgets” article.

Understanding and consistently applying these risk management concepts ensures that all stakeholders share the same language when it comes to managing uncertainty.

Types of Risks in Project Environments

Projects are exposed to a broad spectrum of risks, and these can generally be grouped into project-related and systemic risks.

Project-related risks arise from within the project itself. Therefore, some examples are scope changes, design errors, resource shortages, or contractor performance issues.

Systemic risks, on the other hand, exist within the organization or team and influence the eventual outcome of the project. Common examples include poor contract management, inexperienced project managers, weak systems, and gaps in competencies. These risks are particularly challenging in the early phases of a project, when project maturity is low and less information is available. As the project progresses and more data becomes accessible, systemic risks tend to decrease in severity.

With the support of project risk management software, organizations can carefully analyze systemic risks from the outset, ensuring that all risks are identified, monitored, and addressed effectively. Especially, when these tools have a built-in database with the most common systemic risks.

Methods to Effectively Manage Risks

Organizations employ a variety of methods to structure and operationalize project risk management.

- Qualitative techniques rely on expert judgment and probability-impact assessments to rank risks by importance.

- Quantitative methods, such as Monte Carlo simulations, provide statistical insights into potential cost and schedule outcomes.

- Scenario planning offers another layer of foresight by testing different “what-if” cases, while risk workshops create collaborative opportunities for stakeholders to surface and prioritize risks.

- Stage-gate reviews, then act as structured checkpoints to ensure that risks are properly addressed before the project moves into subsequent phases. The latter is less of a method but still provides a valuable input for identifying risks.

When combined, these approaches and methods allow organizations to balance big-picture foresight with detailed analysis, ensuring risks are managed both strategically and tactically.

Tools for Risk Management

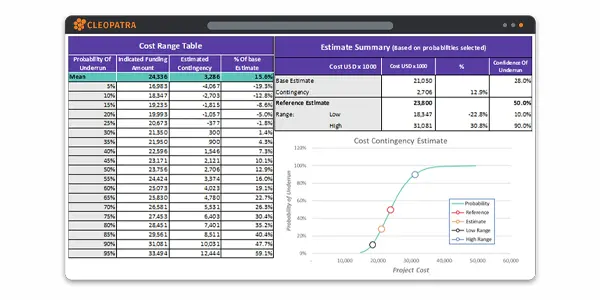

While methodologies provide the framework, tools bring project risk management to life. Risk registers and databases allow project teams to record, categorize, and track risks, ensuring accountability and continuity. Scheduling platforms and project controls software, such as Primavera and Cleopatra Enterprise, go further by embedding risk analysis directly into budgets and time, enabling integrated forecasting and planning that includes potential risks.

Quantitative methods can be supported through simulation software that models possible outcomes and helps teams prepare for a range of scenarios. Think about Crystal Ball (Oracle), ValidRisk, and more.

Finally, dashboards and reporting solutions provide the transparency needed to monitor risk exposure and mitigation progress in real time. These keep both project managers and executives informed.

By embedding these tools into daily project practices, organizations shift from reactive firefighting to predictive risk management, increasing their chances of delivering large capital projects successfully and with greater certainty.

According to Dodge Construction Network’s survey, 70% of owners and contractors agree that better communication and coordination across…

Operational efficiency in project management is about achieving more with less: delivering projects on time and within budget…

Related resources

Cost overruns in projects: meaning, causes, and how to prevent them

Discover the top 5 reasons for project cost overruns, a practical checklist to prevent them, and expert strategies to manage overruns effectively.

Read blog article

How to reduce scope growth with Change Management

Managing changes is essential in successfully performing cost control. Estimate and process the impact of changes to reduce the scope growth.

Read blog article